Introduction:

In recent years, Micro, Small, and Medium Enterprises (MSMEs) have faced numerous challenges in managing their operations effectively, including financial instability, regulatory compliance, and operational risks.

One key challenge faced by MSMEs is the lack of resources to effectively manage their operations and ensure compliance with regulatory requirements. Due to limited budgets and manpower, MSMEs often struggle to conduct comprehensive risk assessments and implement robust internal control systems. As a result, they are exposed to a higher risk of fraud, errors, and non-compliance, which can have a negative impact on their business performance and reputation.

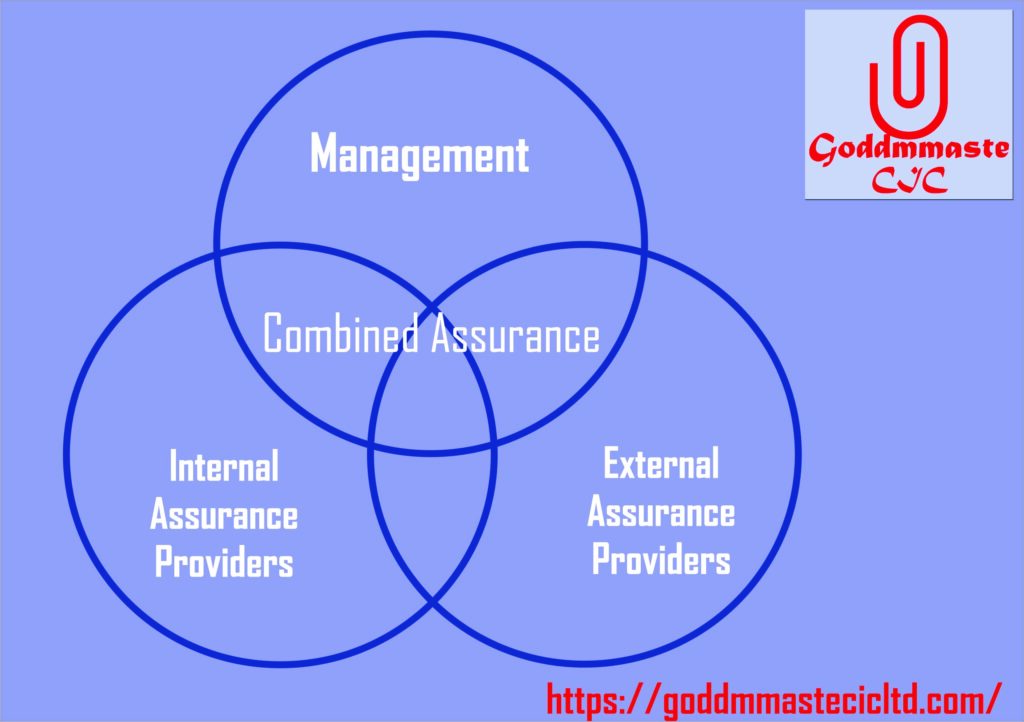

To address these challenges, MSMEs can leverage combined assurance, a holistic approach that combines different types of assurance activities, including internal audit, external audit, compliance reviews, and risk management. By integrating these activities, MSMEs can enhance the effectiveness of their control systems and better manage operational risks.

Combined assurance is a concept in the field of internal auditing that involves the collaboration and coordination of various assurance providers within an organization to strengthen and enhance the overall assurance process. This approach seeks to combine the efforts of internal audit, risk management, compliance, and other assurance functions to provide a comprehensive and holistic view of the organization’s governance, risk management, and control processes.

One of the key components of combined assurance is the use of Management Self-Managed Services (MSMSs) to streamline and automate assurance processes. MSMSs are tools and systems that allow organizations to manage and monitor their internal control environment, identify potential risks and control weaknesses, and ensure compliance with regulations and policies. These systems enable organizations to identify, assess, and mitigate risks in real-time, leading to more effective and efficient assurance processes.

The operations of MSMSs typically include the following key functions:

1. Risk Assessment: MSMSs allow organizations to conduct regular risk assessments to identify potential threats and vulnerabilities that could impact the achievement of their objectives. This helps organizations to prioritize and allocate resources towards mitigating the most critical risks.

2. Control Monitoring: MSMSs provide organizations with the capability to monitor the effectiveness of internal controls in real-time. By automating control monitoring processes, organizations can quickly identify control deficiencies and take corrective action to address any weaknesses.

3. Compliance Management: MSMSs help organizations to ensure compliance with laws, regulations, and internal policies by providing tools and systems to track and report on compliance activities. This helps organizations to reduce the risk of non-compliance and mitigate potential legal and reputational risks.

4. Reporting and Analytics: MSMSs offer reporting and analytics capabilities that enable organizations to track and measure the effectiveness of their assurance processes. By providing real-time data and insights, organizations can identify trends, patterns, and areas for improvement that can enhance the overall assurance function.

Other components of combined assurance are:

Internal Audit:

Internal audit plays a crucial role in providing independent and objective assurance on the effectiveness of an organization’s governance, risk management, and control processes. Internal auditors can assess the MSMEs’ internal control systems, identify control weaknesses, and recommend improvements to strengthen the organization’s operations.

External Audit:

External audit provides an independent assessment of an organization’s financial statements and compliance with regulatory requirements. External auditors can help MSMEs identify financial risks and compliance issues, as well as provide recommendations to improve their financial reporting and internal control processes.

Compliance Reviews:

Compliance reviews focus on ensuring that MSMEs comply with relevant laws, regulations, and industry standards. By conducting regular compliance reviews, MSMEs can identify potential compliance issues and take corrective actions to avoid regulatory penalties and reputational damage.

Risk Management:

Risk management is essential for MSMEs to identify, assess, and mitigate operational risks that may impact their business performance. By integrating risk management activities with internal audit, external audit, and compliance reviews, MSMEs can develop a comprehensive risk management framework to proactively manage risks and enhance business resilience.

Benefits of combined assurance:

Leveraging combined assurance can provide MSMEs with several benefits, including:

a. Enhanced risk management: By integrating different assurance activities, MSMEs can identify and mitigate operational risks more effectively.

b. Improved internal control systems: Internal audit and external audit can help MSMEs identify control weaknesses and implement robust control systems to prevent fraud and errors.

c. Compliance with regulatory requirements: Compliance reviews can help MSMEs ensure they comply with relevant laws, regulations, and industry standards, reducing the risk of regulatory penalties.

d. Cost-effective assurance: By combining different assurance activities, MSMEs can maximize the use of their resources and achieve cost-effective assurance coverage.

Case Study:

XYZ Company, a medium-sized manufacturing MSME, faced challenges in managing its operations and complying with regulatory requirements. To address these challenges, XYZ Company adopted a combined assurance approach by integrating internal audit, external audit, compliance reviews, and risk management activities.

XYZ Company’s internal audit team conducted a comprehensive review of its internal control systems and identified control weaknesses in the procurement process. The external audit team identified financial risks related to inventory valuation and recommended improvements to strengthen financial reporting. Compliance reviews helped XYZ Company ensure compliance with environmental regulations and industry standards.

By leveraging combined assurance, XYZ Company improved its risk management capabilities, strengthened its internal control systems, and enhanced compliance with regulatory requirements. As a result, XYZ Company was able to mitigate operational risks, prevent fraud and errors, and achieve cost-effective assurance coverage.

Conclusion:

Leveraging combined assurance can help MSMEs enhance their operations, manage risks effectively, and comply with regulatory requirements.

By integrating internal audit, external audit, compliance reviews, and risk management activities, MSMEs can strengthen their control systems, improve financial reporting, and achieve cost-effective assurance coverage.

As MSMEs continue to navigate the complex business environment, combined assurance offers a holistic approach to support their operations and drive business success.